Wage garnishments: A lot of work for the employer

When employees are over their heads with debt, it quickly becomes a problem for teams and managers. Money worries wear on the nerves. And on the performance of those in debt. Employers have a lot of work on their hands at the latest when wages are garnished. Preventive programs in the company can avoid employee debt.

Anyone who has ever stood at an ATM and been shocked to discover that it simply won't spit out any money knows how much stress this can cause. Especially when the fridge is empty and the rent and electricity bill for the next month still need to be paid. Stress is inevitable with an empty account. And stress is known to make you ill.

A study by the University of Mainz has shown that eight out of ten over-indebted people suffer from an illness. In most cases, those affected suffer from mental illness. They have anxiety, feel inferior, become depressed and can even be afflicted by psychoses. Joint and spinal disorders are also among the most common ailments suffered by those in debt. Social problems soon follow: Contact with family and friends suffers - and this in turn leads to stress and further psychological strain.

People in debt are often ill

This also has consequences for the employer. Stress and illness cannot simply be handed in at the office door like a jacket or hat. The two scientists So-Hyun Joo and E. Thomas Garman found in their 1998 study "The Potential Effects of Workplace Financial Education" that debt can lead to increased absenteeism, presenteeism and reduced productivity. In later studies, Garman was able to prove that financial stress has a direct and straightforward negative impact on work performance.

People who are afraid that they will no longer be able to pay their rent and that the bailiff will soon be at their door are more likely to sleep badly, be tired during the day, lose concentration and make mistakes. "This can be particularly problematic for companies and organizations that have to ensure a high level of safety. A completely exhausted bus driver, a stressed nurse or an absent bank employee are always a potential source of danger for companies," says Regina Benzinger, head of the debtor and insolvency advice center at pme Familienservice. She has been advising employees in financial difficulties for 13 years.

To the article: Corona and loss of earnings: The latest regulations on state subsidies

"Nobody has anything to be ashamed of"

Regina Benzinger knows how much people suffer from their debts. But many find it difficult to take the step to seek advice. Shame, addiction or illness prevent those affected from calling her. On average, those affected wait up to four years before seeking professional help. "Nobody really needs to be ashamed. It can happen quickly that you get into debt. In most cases, critical life events and strokes of fate such as illness, death, unemployment or separation from a partner lead to over-indebtedness," explains Benzinger.

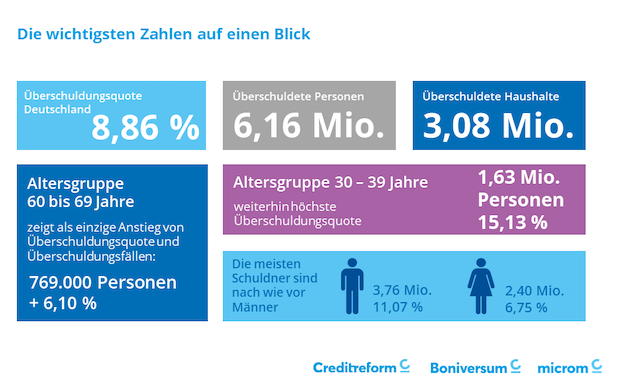

(Photo: Debtor Atlas 2021, www.boniversum.de/studien/schuldneratlas)

Wage garnishments: A lot of work for the employer

Hiding, concealing, pretending nothing is wrong: even if the manager is unaware of the employee's debts and stress, the employer will know about it at the latest when the debtor's garnishment of wages lands in their letterbox and will be held liable - which in turn means additional work and extra costs for the company. "It often doesn't stop at a single garnishment of wages: The next garnishment and transfer order is already on the table before the first one has been dealt with," says Regina Benzinger. Among other things, the employer must determine the attachable part of the salary as correctly as possible. If there are several creditors involved, the employer as third-party debtor must even take into account the respective priority of the various creditors.

Low wages and no reserves are the basic problem

One in seven consumers in Germany is over-indebted. Anyone can be affected. The corona crisis is also driving people into debt who have never had this problem before. Many people were able to save money during the crisis. According to the Federal Statistical Office, every fourth euro was put into a piggy bank. On the other hand, at least 300,000 people had to take on debt to make ends meet, as the German Institute for Economic Research and Bielefeld University analyzed in February 2021.

Those who already had little to no reserves before the crisis are particularly affected. If there is then a temporary loss of income, such as during the coronavirus crisis, it becomes difficult to cushion the impact. Compared to 2008 (before the financial crisis), three times as many people now state that they are unable to make a living without debt due to a "long-term low income".

To the article: Income and budget advice for employees with low incomes

Middle class also affected by coronavirus crisis

And the corona crisis continues to cause income losses. This also affects people from the so-called middle class, who have exhausted their financial reserves after more than a year of short-time working. On December 2, 2021, the federal and state governments decided on a nationwide 2G rule for stores, leisure events and major events. "This means that many employees will be sent back into short-time work and student assistants will not even be needed. It means a loss of income for everyone, and these are potential triggers for over-indebtedness," says financial advisor Frank Wiedenhaupt, who works for the Berlin City Mission. His clients' nerves have become increasingly frayed over the course of the crisis. "We are experiencing the mental exhaustion of those seeking advice in practically every consultation."

ROI of 300 percent: company prevention programs help

No prevention program, no income and budget advice can prevent a divorce, an accident or other sudden and critical life events. However, it can certainly help if employers can quickly provide their employees with information and advice as soon as critical events occur that also have financial consequences. It also makes sense to inform employees about financial support in the event of marriage, pregnancy, a house purchase or illness and death, to have information material available and to point out financial consequences should they have money problems.

To the article: Retirement planning for women: 5 tips from money coach Dani Parthum

At the same time, dealing openly with the topic of finances and debt helps to remove the taboo from the subject and bring more people in for advice. It is also clear that people with financial knowledge are less likely to behave riskily and are therefore less likely to get into financial difficulties. Studies have shown that employees with a low level of education and little savings benefit most from company financial education programs.

This is also Regina Benzinger's experience in her consultations: "It is often a lack of financial literacy that drives those affected into the red." According to a study by author and financial expert E. Thomas Garman, programs that impart financial knowledge can achieve a return on investment of 300 percent or more. Financial education is also said to motivate employees and leads to better concentration and less absenteeism.